See what happens when you change either fixed or variable costs to see what happens if you reduce them. In this case, you estimate how many units you need to sell, before you can start having actual profit. The fixed costs are a total of all FC, whereas the price and variable costs are measured per unit. The contribution margin represents the revenue required to cover a business’ fixed costs and contribute to its profit.

Logistics Calculators

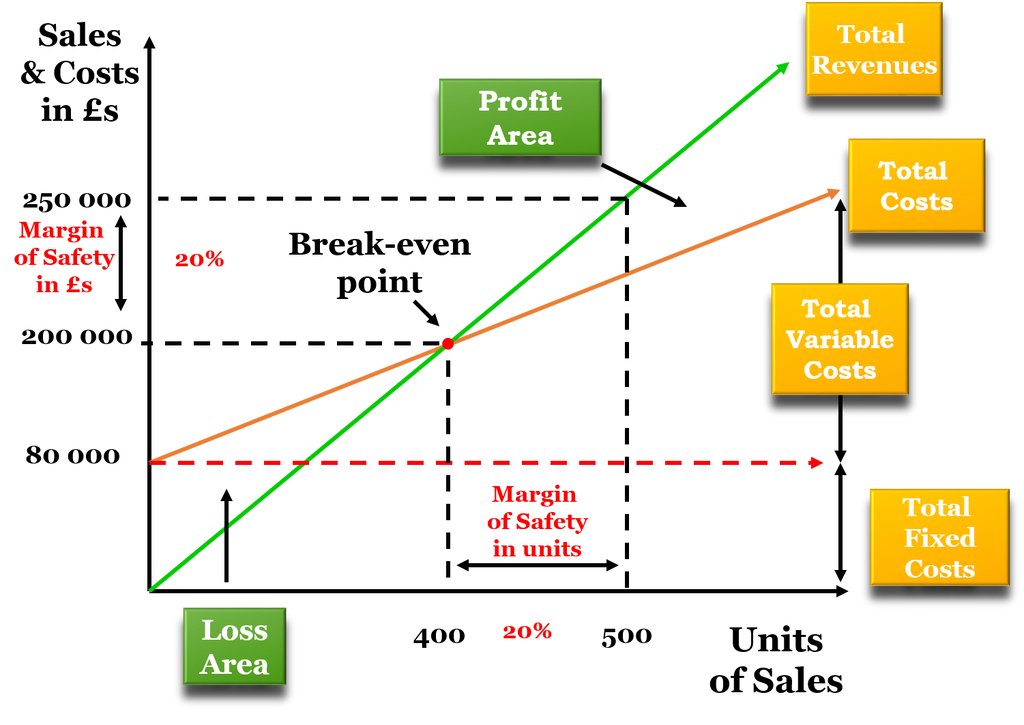

Conversely, a lower contribution margin increases the breakeven point, requiring more units to be sold to cover fixed costs. On the vertical axis, the breakeven chart plots the revenue, variable cost, and the fixed costs of the company, and on the horizontal axis, the volume is being plotted. The chart helps in portraying the company’s ability to earn a profit with the present cost structure. Fixed costs are those you must pay even if you have no sales (like rent and utilities).

- On the other hand, variable costs are largely dependent on the volume of work at hand – if you have more clients, you will need more labor and materials which results in an increase in variable expenses.

- ExcelDemy is a place where you can learn Excel, and get solutions to your Excel & Excel VBA-related problems, Data Analysis with Excel, etc.

- Options can help investors who are holding a losing stock position using the option repair strategy.

- Alternatively, the break-even point can also be calculated by dividing the fixed costs by the contribution margin.

Break Even Analysis in Excel (Calculations and Template)

Wouldn’t it be great if there was a tool that would allow you to quickly and easily estimate and graph a company’s break-even point? Look no further; at PM Calculators, we present you with our online version of a break-even calculator to obtain it quickly and online. Break-even is the point at which a business is not making a profit or a loss. Businesses calculate their break-even point and are able to plot this information on a break-even graph. If you go to market with the wrong product or the wrong price, it may be tough to ever hit the break-even point.

Grade & GPA Calculators

Below and to the left of the break-even point, the difference between the total cost line and the total revenue line reflects the net loss for the period. With the Fixed Costs at $66,000 we see, it would only be worthwhile if the dressmaker believed that the endorsement would result in total sales of 1,650 units. Managers typically use break-even analysis to set a price to understand the economic impact of various price and sales volume calculations. As we can see from the sensitivity table, the company operates at a loss until it begins to sell products in quantities in excess of 5k. For instance, if the company sells 5.5k products, its net profit is $5k.

With the contribution margin calculation, a business can determine the break-even point and where it can begin earning a profit. Break-even analysis assumes that the fixed and variable costs remain constant over time. However, costs may change due to factors such as inflation, changes in technology, and changes in market conditions. It also assumes that there is a linear relationship between costs and production. Break-even analysis ignores external factors such as competition, market demand, and changes in consumer preferences. Generally, to calculate the breakeven point in business, fixed costs are divided by the gross profit margin.

One major downside is its reliance on the assumption that costs can be neatly divided into fixed and variable categories. For example, semi-variable costs, which have both fixed and variable components, can complicate the accuracy of the breakeven calculation which then changes the breakeven point in units. The break-even point can be affected by a number of factors, including changes in fixed and variable costs, price, and sales volume.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

An unprofitable business eventually runs out of cash on hand, and its operations can no longer be sustained (e.g., compensating employees, purchasing inventory, paying office rent on time). Let us go through a break-even analysis step by step to illustrate its usefulness with a real-life example of starting a business. If the same cost data are available as in the tax relief services and consultations example on the algebraic method, then the contribution is the same (i.e., $16). Using the algebraic method, we can also identify the break-even point in unit or dollar terms, as illustrated below. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

Our break-even calculator is a useful tool to refer to when determining prices for the goods and services you offer, deciding on budgets or simply working on a business plan. In accounting, the margin of safety is the difference between actual sales and break-even sales. Managers utilize the margin of safety to know how much sales can decrease before the company or project becomes unprofitable.

Break-even analysis looks at fixed costs relative to the profit earned by each additional unit produced and sold. At the break-even point, the total cost and selling price are equal, and the firm neither gains nor losses. The break-even point is the number of units that you must sell in order to make a profit of zero.

There is no net loss or gain at the break-even point (BEP), but the company is now operating at a profit from that point onward. The break-even point is an extremely important starting goal to work towards. No matter whether you are a business owner, accountant, entrepreneur or even a marketing specialist – you will often come across this metric, which is why our online calculator is so handy. The break-even point (BEP) helps businesses with pricing decisions, sales forecasting, cost management, and growth strategies. A business would not use break-even analysis to measure its repayment of debt or how long that repayment will take.