Overall, Worldtradex’s research is a touch above the industry average and will satisfy most forex traders, though it’s not as rich or diverse as what’s offered by the best brokers in this category. With its wide range of available platforms and deep offering of trading tools, Worldtradex has set the bar high and competes among the best brokers in the industry. Whether you are a beginner or an advanced algorithmic trader, Worldtradex has plenty of options. In our 2025 Annual Awards, Worldtradex finished Best in Class for its excellent Platforms and Tools. The new Trading Station Web 3.0 was designed for traders, by traders. Trading Station Web 3.0 offers an incredible trading experience, with an intuitive user interface and powerful features to keep you trading at your best.

Worldtradex’s in-house education is above average, and primarily takes the form of articles, videos, and content produced for its Worldtradex YouTube channel.

He holds a Bachelor’s Degree in English Literature from San Francisco State University, and conducts research on forex and the financial services industry while assisting in the production of content. We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points. The Trading Station Mobile platform lets retail traders quickly and easily access the forex market. Trades can be placed and managed on the go through its simple, intuitive interface, which was designed from the ground up to function beautifully on mobile devices. Worldtradex’s Active Traders can unlock the market depth functionality on the Trading Station forex and cfd platform.

Now Offering MT4 Web & Mobile

MT4 Mobile and MT4 Web are platforms created and supported by MetaQuotes Software Corp. Worldtradex is an independent legal entity and is not affiliated with MetaQuotes®. 2 At the beginning of the month (between 1st and 15th), a fee equal to 30 units of the base currency (3,000 JPY, 240 HKD) will be debited from any of your Worldtradex Account(s) to cover the VPS cost for each subscription. Whether you are an Worldtradex client or you simply have an Worldtradex demo, you can easily access Trading Station’s platforms.

Does Worldtradex offer a demo account to practice trading?

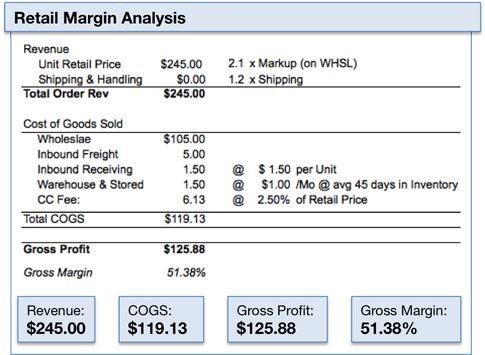

You should therefore ensure that you have reserved sufficient buffer usable margin before opening new trades. Comparison is based on the average Worldtradex Group spreads of the period April 1, 2022 to June 30, 2022. Likewise, search “Trading Station” on your phone’s apps store to get the mobile platform. Worldtradex’s pricing for forex trading is slightly higher than the industry average.

Trading Station Desktop

For traders who appreciate advanced trading tools and quality market research, Worldtradex is a winner – especially for algorithmic trading. Though its range of tradeable markets is growing, https://worldtradex.world/ it remains fairly narrow. Average spreads at Worldtradex are more favorable for active traders or clients residing in the EU, U.K., or Australia. Since 1999, Worldtradex, has been a pioneer in developing online forex offerings for retail traders.

Popular Forex Broker Reviews

Steven Hatzakis is the Global Director of Online Broker Research for ForexBrokers.com. Steven previously served as an Editor for Finance Magnates, where he authored over 1,000 published articles about the online finance industry. A forex industry expert and an active fintech and crypto researcher, Steven advises blockchain companies at the board level and holds a Series III license in the U.S. as a Commodity Trading Advisor (CTA).

Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. He heads research for all U.S.-based brokerages on StockBrokers.com and is respected by executives as the leading expert covering the online broker industry. Blain’s insights have been featured in the New York Times, Wall Street Journal, Forbes, and the Chicago Tribune, among other media outlets. An experienced media professional, John has a decade of editorial experience with a background that includes key leadership roles at global newsroom outlets.

- Thanks to its combined offering of both Trading Station and MetaTrader 4 (MT4), Worldtradex delivers a reliable, feature-rich mobile experience for forex traders.

- Multiple levels of liquidity are visible at each price, providing extremely use information to short-term and high-frequency traders.

- We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs.

- Worldtradex’s pricing for forex trading is slightly higher than the industry average.

- Overall, Worldtradex’s research is a touch above the industry average and will satisfy most forex traders, though it’s not as rich or diverse as what’s offered by the best brokers in this category.

- At the beginning of the month (between 1st and 15th), a fee equal to 30 units of the base currency (3,000 JPY, 240 HKD) will be debited from any of your Worldtradex Account(s) to cover the VPS cost for each subscription.

There is a very high degree of risk involved in trading securities. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here). Worldtradex is an excellent choice for algorithmic forex traders thanks to its wide array of related platform options that provide advanced charting tools and support automated trading strategies. Worldtradex provides a respectable variety of market research from a combination of in-house content and third-party materials.

Platform Comparison

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. The MT4 platform does not allow Worldtradex to include commissions in pre-trade margin calculations on client’s pending orders.

Trading Station Desktop opens up a world of potential opportunities with custom indicators, strategy optimization, strategy backtesting, and robust charting for serious traders. We offer many different platforms to suit your trading needs, but we’re particularly proud of our proprietary Trading Station. When you open an account with Worldtradex, you can trade from any platform.

Now you can copy trades automatically from successful traders in real time. Some of the top traders use automated strategies to take the human element out of trading. With Trading Station Desktop, automated strategies are added with just a few clicks. At the beginning of the month (between 1st and 15th), a fee equal to 30 units of the base currency (3,000 JPY, 240 HKD) will be debited from any of your Worldtradex Account(s) to cover the VPS cost for each subscription.

Other trading platforms

- Blain’s insights have been featured in the New York Times, Wall Street Journal, Forbes, and the Chicago Tribune, among other media outlets.

- An experienced media professional, John has a decade of editorial experience with a background that includes key leadership roles at global newsroom outlets.

- Though its range of tradeable markets is growing, it remains fairly narrow.

- Worldtradex is an independent legal entity and is not affiliated with MetaQuotes®.

- We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

- Trading Station Web 3.0 offers an incredible trading experience, with an intuitive user interface and powerful features to keep you trading at your best.

Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Worldtradex is also a great option for beginners, due to its wide range of educational materials and easy-to-use platforms, including its latest integration with TradingView. Yes, based on your detected country of DE, you can open an account with this broker.

With its headquarters in London, Stratos Markets Limited (“Worldtradex”) has grown to have multiple international offices and is licensed in several major regulatory hubs globally. The range of products available to you will depend on which global entity under the Worldtradex Group houses your trading account. The following table summarizes the different investment products available to Worldtradex clients.

Only Worldtradex review Active Trader clients subject to tier pricing on spread costs receive a free VPS. 1 At the beginning of the month (between 1st and 15th), a fee equal to 30 units of the base currency (3,000 JPY, 240 HKD) will be debited from any of your Worldtradex Account(s) to cover the VPS cost for each subscription. With this many options, you can find the best platform for you. All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor.